SPX Options Strategy | 3DTE Put Credit Spread Strategy

SPX Options Strategy | Fridays

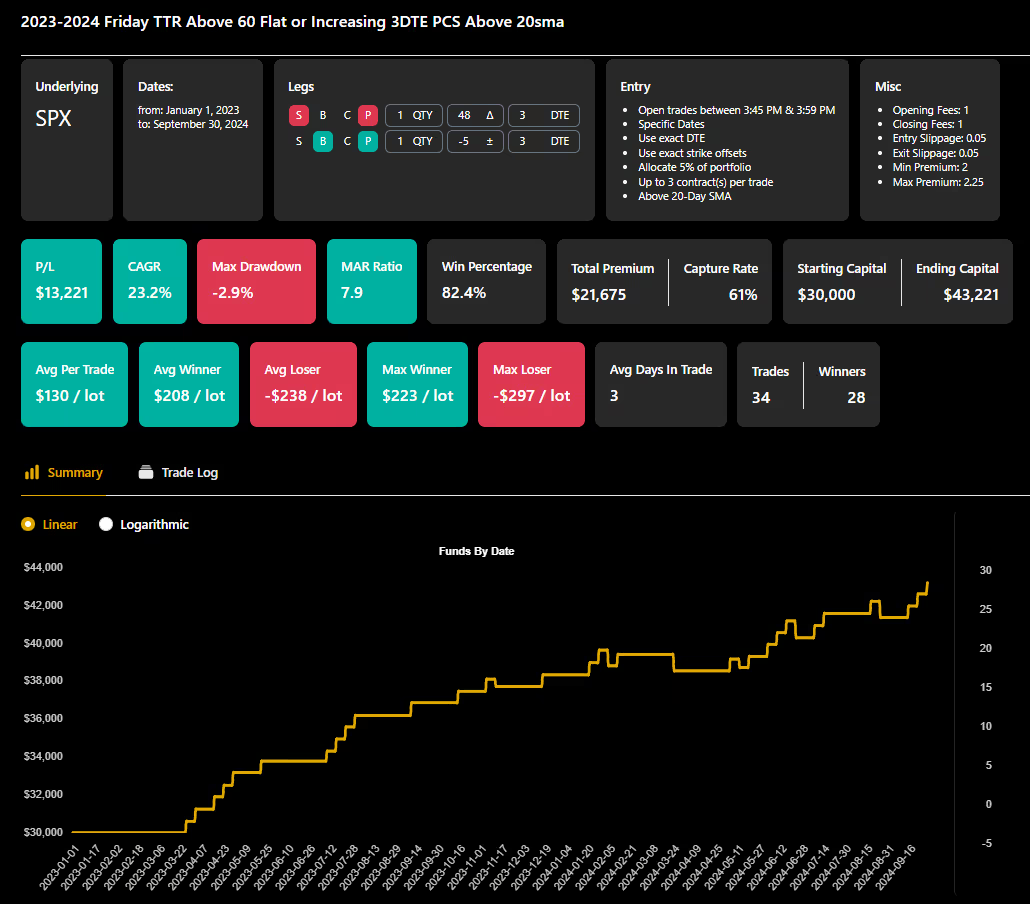

The SPX weekly options trading research study finds an edge by combining Alpha Crunching's TTR or Tomorrow's Triumph Rate with the 20sma for trading at the money put credit spreads with 3 days to expiration on Friday's.

Alpha Crunching considers each day of the week of having its own characteristics and seasonality. This research takes trades on Friday afternoon if the following criteria is met.

Alpha Crunching's TTR or Tomorrow's Triumph Rate is updated each weekend before the trading week begins and shows the historical percentage of times SPX has closed higher the next day over the past two months.

For Fridays, if the TTR is above 60% and flat to higher from the previous week as shown above, then a put credit spread towards Friday's close is a potential trade candidate.

For bullish confirmation, SPX needs to be above its 20sma on the daily chart about 15m before the close that Friday before taking this trade. If SPX is below its 20sma, the trade is skipped.

This strategy sells an ATM (at the money) put credit spread expiring the following the next trading day (3DTE) with the goal of receiving at least a $2.00 credit for a 5 point wide spread. This creates a 3:2 risk reward or better for the bull put spread.

This SPX options strategy held the spread to expiration and ran an 82% win rate from January 2023 through September 2024.

.avif)

.avif)

.avif)

.avif)