Call Spread Option Strategy

SPX Call Spread Option Strategy | Mondays

What is a Call Spread?

A call spread is an options strategy that involves buying one call option while simultaneously selling another call option with the same expiration date. This strategy limits both potential profit and risk, making it a more controlled way to trade bullish or bearish market expectations.

There are two main types of call spreads:

- Bull Call Spread – Used when expecting a moderate price increase. The lower strike call is purchased, and the higher strike call is sold to offset some of the cost.

- Bear Call Spread – A bearish strategy where a lower strike call is sold while a higher strike call is bought, aiming to profit from limited upside movement or time decay.

Call spreads are useful for traders looking to balance risk and reward while reducing capital requirements compared to outright call buying.

This article details a bull call spread strategy for SPX. A bull call spread is also known as a call debit spread(CDS) because the trade is opened as a debit.

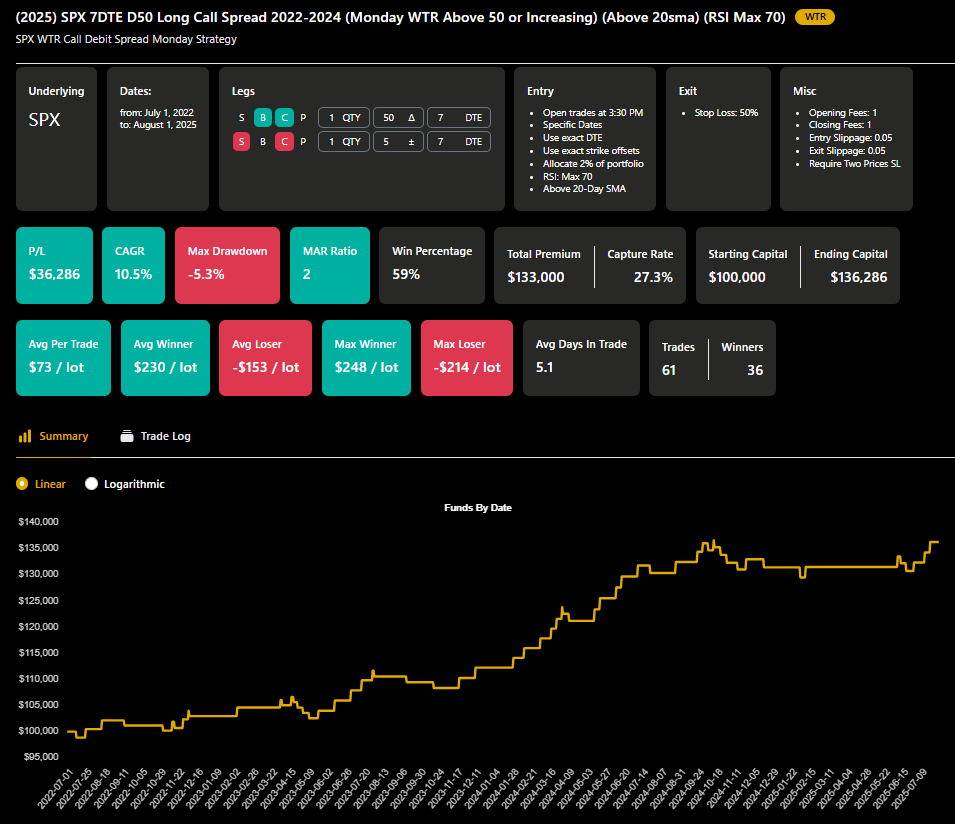

The research in this article reveals an edge for this strategy by combining Alpha Crunching's WTR (Weekly Triumph Rate) with the 20sma and RSI for trading bull call spreads with 7 days to expiration on Mondays. Strike selection and trade management also play a roll in this strategy's performance by offering a better than 1:1 risk reward with a better than 50% win rate.

Let's Get Into It

First, Alpha Crunching considers each day of the week of having its own characteristics and seasonality. This research takes trades on Monday afternoon if the following criteria is met.

Alpha Crunching's WTR or Weekly Triumph Rate is updated each weekend before the trading week begins and shows the historical percentage of times SPX has closed higher 7 days later over the past two months.

For Mondays, if the WTR is above 50% or below 50% and increasing from the previous week as shown above, then buying an SPX call spread (CDS) towards Monday's close is a potential trade candidate.

For bullish confirmation, SPX needs to be above its 20sma on the daily chart about 30m before the close that Monday before taking this trade. If SPX is below its 20sma, the trade is skipped. We also don't want the RSI(14) on the SPX daily chart to be above 70 indicating an overbought condition. If the RSI(14) is above 70, then the trade would also be skipped.

This strategy buys a Delta 50 call option and sells the next higher strike on SPX with 7DTE(days to expiration). This strategy uses a 50% Stop Loss and will hold the spread to expiration creating a better than 1:1 risk reward.

Note: Because SPX is a cash settled index, traders can let the options expire in the money with out fear of assignment.

This SPX options strategy has a 59% win rate from July 2022 through August 1, 2025 in which the winning trades about 1.5 times the size as the losing trades. The historical backtest above uses a $100,000 account allocation 2% per trade. This is not a recommendation but gives you a reference point of allocation to start with.

In this example, an allocation of 2% shows a CAGR of 10.5% per year during this lookback period and highlights the power of leveraging SPX bull call spreads during bullish market conditions in a systematic way.

To make it even easier, Alpha Crunching provides a list of backtested trade ideas each week before the trading week begins so you know what to focus on in the upcoming week. The Trade Ideas tab is updated every Sunday and includes this SPX bull call spread option strategy when the data supports it. It even reminds you of the time of day and the technical conditions to be met prior to entry. As you can see, we refer to this strategy as the SPX WTR 7DTE CDS strategy on the Trade Ideas tab.

If you click on any of the Trade Ideas, you'll get more details for each trade as a reminder of the strategy which includes a link to a blog post so you can see the most recent historical backtest.

Here at Alpha Crunching, we've tried to take the guess work out of finding and implementing backtested strategies so you don't have to watch the market all day.

.avif)

.avif)